Get the free 206 0786 cosigner fillable form

Show details

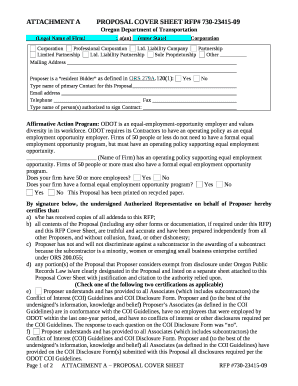

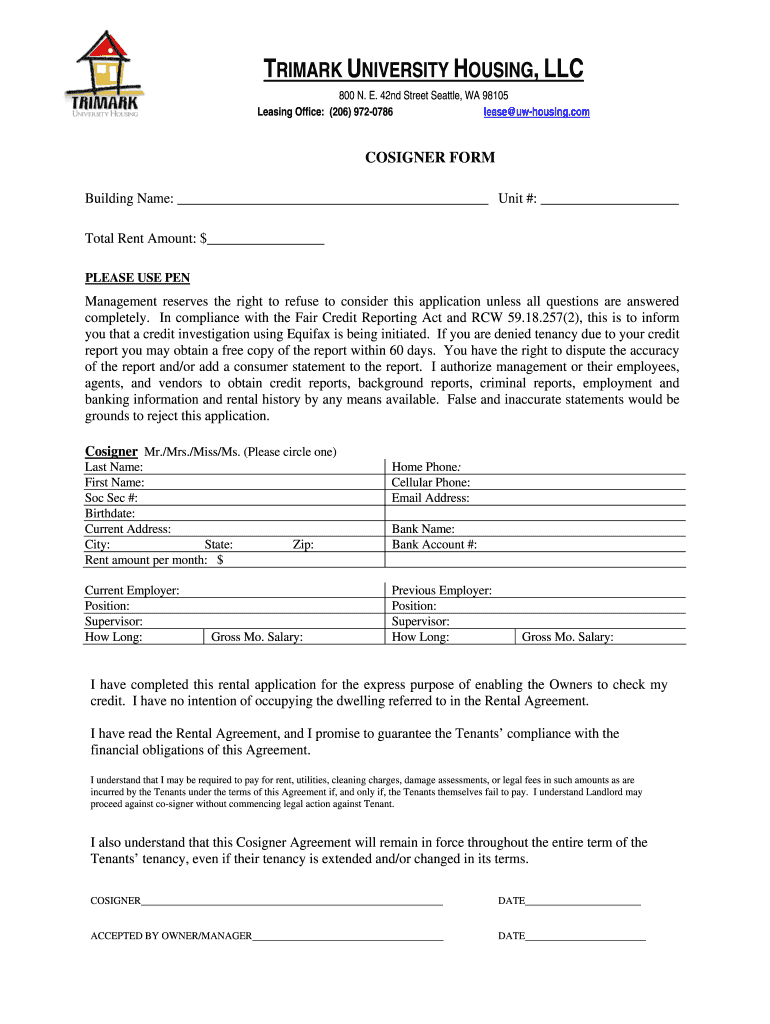

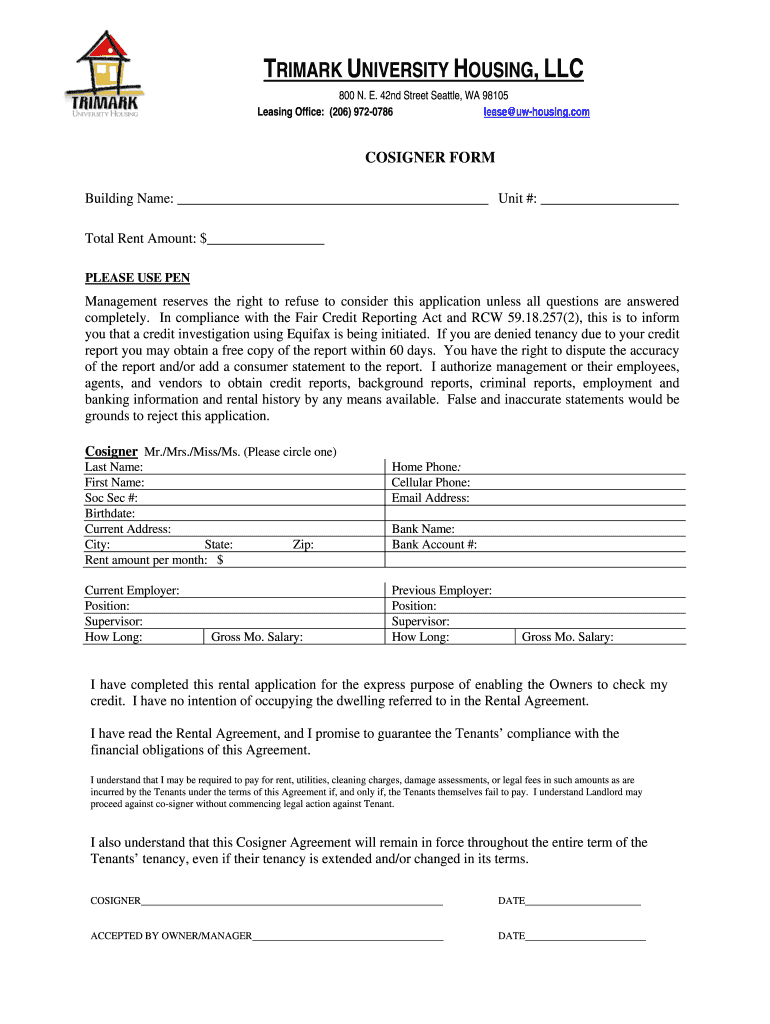

TRIM ARK UNIVERSITY HOUSING, LLC 800 N. E. 42nd Street Seattle, WA 98105 Leasing Office: (206) 972-0786 lease uw-housing.com COSIGNER FORM Building Name: Unit #: Total Rent Amount: $ PLEASE USE PEN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 206 0786 cosigner form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 206 0786 cosigner form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 206 0786 cosigner fillable online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit housing 0786 form fillable. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out 206 0786 cosigner form

How to fill out federal irs?

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income and expense records.

02

Organize your paperwork and make sure all information is accurate and up-to-date.

03

Determine your filing status (e.g., single, married filing jointly, head of household) and choose the appropriate tax form (such as Form 1040, 1040A, or 1040EZ).

04

Calculate your income by adding up all sources of taxable income, including wages, self-employment income, dividends, and interest.

05

Deduct any eligible expenses or deductions, such as business expenses, student loan interest, and mortgage interest.

06

Determine your tax liability by applying the appropriate tax rates and brackets to your taxable income.

07

Determine if you qualify for any tax credits or deductions, such as the Earned Income Tax Credit or Child Tax Credit.

08

Fill out all necessary sections of the tax form, including personal information, income, deductions, and credits.

09

Double-check all the information entered and make sure it is accurate and complete.

10

Sign and date the tax form, and if applicable, attach any additional schedules or forms.

11

Keep a copy of your completed tax return for your records.

12

Submit your tax return to the IRS by mail or electronically.

Who needs federal irs?

01

Individuals who earned income above the specified threshold set by the IRS during the tax year.

02

Business owners, self-employed individuals, and freelancers who have taxable income.

03

Married couples who file jointly or separately and meet the filing requirements.

04

Individuals who receive income from rental properties, investments, or other sources subject to federal income tax.

05

Parents or guardians who claim dependents for tax purposes.

06

Individuals who qualify for tax credits or deductions, such as students or low-income earners.

07

U.S. citizens or resident aliens living abroad, who may have to report their foreign income.

08

Anyone who is unsure if they need to file should consult the IRS guidelines or seek professional advice.

Fill university housing llc cosigner pdf : Try Risk Free

People Also Ask about 206 0786 cosigner fillable

What is IRS 1040 form?

What is a w9 form used for?

How do I request an IRS form?

Can you print out IRS forms?

How do I get an official IRS form?

How do I check my federal taxes?

How do I talk to someone at the IRS?

How much do I owe the IRS phone number?

How to fill out 2023 W4 for maximum withholding?

How do I fill out a free IRS form?

What is the correct way to file a federal income tax return?

What form do you fill out to complete your federal tax return?

How do I fill out a federal tax check?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is federal irs?

The Internal Revenue Service (IRS) is a bureau of the Department of the Treasury and is responsible for administering the federal government’s tax laws. The IRS is responsible for collecting taxes, processing tax returns, auditing taxpayers, and enforcing the laws related to taxation.

Who is required to file federal irs?

In the United States, individuals and organizations with certain income levels and types of income are required to file federal income taxes with the Internal Revenue Service (IRS). The specific filing requirements depend on factors such as filing status, age, and income sources. Generally, U.S. citizens, resident aliens, and certain non-resident aliens must file federal taxes if their income meets the filing threshold set by the IRS. Additionally, individuals who had self-employment income, earned income through wages, salaries, or tips, or received income from dividends, interest, rent, alimony, or capital gains may also have to file. It is important to consult the IRS guidelines or seek advice from a tax professional to determine if you are required to file federal taxes.

What is the purpose of federal irs?

The purpose of the federal Internal Revenue Service (IRS) is to administer and enforce the Internal Revenue Code and related laws, which govern federal taxation in the United States. The IRS collects and processes tax payments, ensures compliance with tax laws, provides assistance to taxpayers in understanding their tax obligations, and investigates and enforces tax-related crimes. Its main goal is to ensure the accurate and timely collection of federal taxes to fund government programs and operations.

When is the deadline to file federal irs in 2023?

The deadline to file federal income taxes for the year 2023 is typically April 15, 2024. However, please note that tax deadlines can change, so it is always advisable to check with the Internal Revenue Service (IRS) or a qualified tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of federal irs?

The penalty for the late filing of federal income tax returns depends on whether you owe taxes or are entitled to a refund.

If you fail to file your tax return by the due date and you owe taxes, there is a penalty for late filing. The penalty is typically 5% of the unpaid tax amount for each month or partial month your return is late, up to a maximum of 25% of the unpaid tax. However, if you file more than 60 days after the due date, the minimum penalty is either $435 or 100% of the unpaid tax, whichever is less.

On the other hand, if you're entitled to a refund and you file your tax return late, there is usually no penalty for late filing. However, the IRS may hold any refund due until the tax return is filed.

It's important to note that penalties and interest can vary based on individual circumstances, so it's recommended to consult the IRS website or a tax professional for specific information related to your situation.

How to fill out federal irs?

To fill out a federal IRS form, you need to follow these general steps:

1. Gather the necessary information: Collect all the required information and documents before starting. This may include your Social Security number or Taxpayer Identification Number (TIN), W-2 forms (earnings statements), 1099 forms (income statements), receipts for deductible expenses, and any other relevant financial documents.

2. Choose the correct form: Select the appropriate IRS form that corresponds to your filing status and situation. The most commonly used forms are the 1040 (individual tax return), 1040A (simplified version of 1040), and 1040EZ (even simpler version).

3. Provide personal information: In the designated spaces, enter your personal details such as your full name, address, Social Security number or TIN, and filing status (e.g., single, married filing jointly, head of household).

4. Report income: Go through each type of income you received during the tax year (wages, dividends, interest, etc.), and input the amounts in the appropriate sections of the form. Attach any necessary income statements such as W-2 or 1099 forms. Make sure to accurately report all income to avoid problems with the IRS.

5. Deduct expenses and claim credits: If you are eligible for deductions or credits, such as student loan interest, mortgage interest, or education credits, carefully follow the instructions provided and claim them in the relevant sections of the form.

6. Calculate and pay taxes owed or request a refund: Once you have completed reporting income, deductions, and credits, calculate your final tax liability using the instructions provided with the form. If you owe taxes, include the payment with your completed form. Alternatively, if you are due a refund, provide your bank information for direct deposit or opt for a paper check.

7. Double-check for accuracy: Review the entire form to ensure all information is accurate and complete. Mistakes or missing information can lead to delays or errors in processing your return.

8. Sign and submit: Sign and date the completed form. If you are filing electronically, follow the instructions provided by the IRS for online filing. If you are mailing your form, make a copy for your records, attach any supporting documents, and send it to the appropriate address provided in the instructions.

It is important to note that these steps are general and may not cover all specific situations. It is recommended to consult the IRS website, seek professional assistance, or use tax preparation software to ensure accurate completion of your federal IRS forms.

What information must be reported on federal irs?

When filing federal tax returns with the Internal Revenue Service (IRS), individuals and businesses are required to report various types of information. The specific information that must be reported depends on the taxpayer's circumstances. Here are some common elements:

1. Personal Information: Basic personal details like name, Social Security number (SSN), or employer identification number (EIN) for businesses.

2. Sources of Income: Accurate reporting of all sources of income, including wages, self-employment income, rental income, investment income, or any other form of earnings.

3. Deductions: Information about eligible deductions, such as education expenses, home mortgage interest, medical expenses, charitable contributions, or business expenses.

4. Credits: Details regarding any tax credits claimed, such as the Child Tax Credit, Earned Income Credit, or education tax credits.

5. Dependents: Information on any dependents, including their names, dates of birth, and SSNs.

6. Filing Status: Choosing the appropriate filing status, such as single, married filing jointly or separately, head of household, or qualifying widow(er) with dependent child.

7. Foreign Assets and Accounts: Reporting foreign bank accounts, investments, and assets if applicable.

8. Health Insurance: Indicating compliance with the Affordable Care Act's individual mandate or claiming any health coverage exemptions.

9. Estimated Tax Payments: Reporting any estimated tax payments made throughout the year.

10. Withholdings: Information on income tax withholdings from paychecks or other sources of income.

These are general categories, and there might be additional forms or schedules required for more specific situations. It is essential to consult official IRS publications or seek professional tax advice to ensure compliance with the specific reporting requirements.

Can I create an electronic signature for the 206 0786 cosigner fillable in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your housing 0786 form fillable in seconds.

How can I edit university housing llc cosigner fillable on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing office 0786 cosigner fillable, you need to install and log in to the app.

Can I edit 0786 cosigner name download on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign university housing llc cosigner form fillable on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your 206 0786 cosigner form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

University Housing Llc Cosigner Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to 0786 cosigner name fillable form

Related to housing 0786 cosigner fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.